All Categories

Featured

Table of Contents

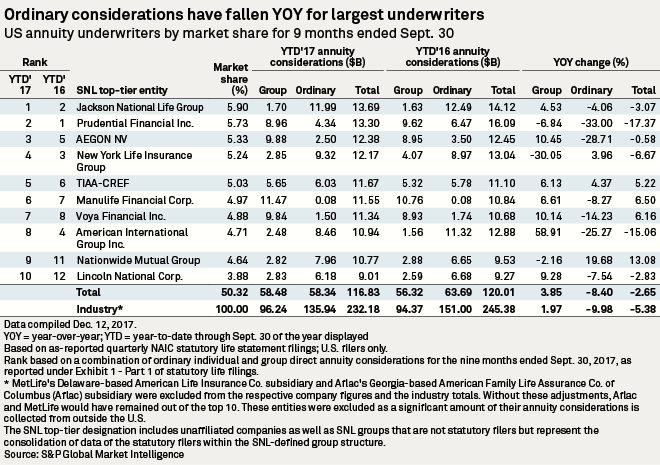

Keep in mind, nevertheless, that this does not say anything about readjusting for rising cost of living. On the plus side, also if you presume your choice would certainly be to buy the supply market for those 7 years, which you would certainly obtain a 10 percent annual return (which is far from certain, especially in the coming decade), this $8208 a year would certainly be greater than 4 percent of the resulting small supply worth.

Instance of a single-premium deferred annuity (with a 25-year deferral), with four settlement choices. The monthly payment right here is highest for the "joint-life-only" option, at $1258 (164 percent higher than with the instant annuity).

The method you buy the annuity will certainly identify the answer to that concern. If you purchase an annuity with pre-tax dollars, your premium reduces your taxable income for that year. According to , getting an annuity inside a Roth plan results in tax-free settlements.

How much does an Annuity Interest Rates pay annually?

The consultant's initial step was to create a detailed financial prepare for you, and after that describe (a) just how the proposed annuity suits your overall plan, (b) what choices s/he considered, and (c) how such options would certainly or would not have actually resulted in lower or greater settlement for the advisor, and (d) why the annuity is the superior selection for you. - Fixed-term annuities

Certainly, an expert might try pressing annuities also if they're not the ideal suitable for your situation and objectives. The factor could be as benign as it is the only item they sell, so they fall victim to the proverbial, "If all you have in your tool kit is a hammer, rather quickly whatever begins appearing like a nail." While the expert in this circumstance may not be dishonest, it enhances the danger that an annuity is an inadequate option for you.

Variable Annuities

Because annuities usually pay the agent marketing them a lot greater compensations than what s/he would certainly obtain for spending your money in mutual funds - Annuity accumulation phase, allow alone the zero compensations s/he 'd obtain if you invest in no-load mutual funds, there is a huge reward for agents to push annuities, and the a lot more difficult the far better ()

A deceitful expert recommends rolling that amount into brand-new "much better" funds that simply happen to lug a 4 percent sales load. Accept this, and the advisor pockets $20,000 of your $500,000, and the funds aren't likely to carry out much better (unless you selected a lot more inadequately to start with). In the same instance, the advisor could steer you to get a challenging annuity with that $500,000, one that pays him or her an 8 percent compensation.

The expert hasn't figured out exactly how annuity settlements will certainly be taxed. The consultant hasn't revealed his/her settlement and/or the charges you'll be charged and/or hasn't shown you the influence of those on your ultimate payments, and/or the compensation and/or charges are unacceptably high.

Present rate of interest rates, and thus predicted settlements, are historically reduced. Also if an annuity is best for you, do your due diligence in contrasting annuities marketed by brokers vs. no-load ones marketed by the releasing business.

What are the top Annuity Contracts providers in my area?

The stream of month-to-month payments from Social Security is similar to those of a postponed annuity. Considering that annuities are voluntary, the individuals buying them usually self-select as having a longer-than-average life expectations.

Social Protection benefits are totally indexed to the CPI, while annuities either have no rising cost of living security or at most supply a set percentage yearly rise that may or may not make up for inflation in full. This type of motorcyclist, similar to anything else that enhances the insurance provider's risk, needs you to pay more for the annuity, or approve reduced payments.

Who has the best customer service for Fixed Indexed Annuities?

Please note: This short article is meant for informational objectives just, and should not be thought about economic suggestions. You must get in touch with a monetary professional before making any kind of significant economic decisions. My job has had lots of uncertain weave. A MSc in academic physics, PhD in experimental high-energy physics, postdoc in bit detector R&D, research position in experimental cosmic-ray physics (including a couple of check outs to Antarctica), a brief job at a small design solutions firm sustaining NASA, adhered to by beginning my own small consulting practice sustaining NASA tasks and programs.

Because annuities are planned for retired life, tax obligations and penalties may apply. Principal Protection of Fixed Annuities. Never ever shed principal due to market efficiency as repaired annuities are not invested in the marketplace. Even throughout market recessions, your cash will not be influenced and you will certainly not lose cash. Diverse Investment Options.

Immediate annuities. Deferred annuities: For those who desire to expand their cash over time, however are ready to defer accessibility to the money till retirement years.

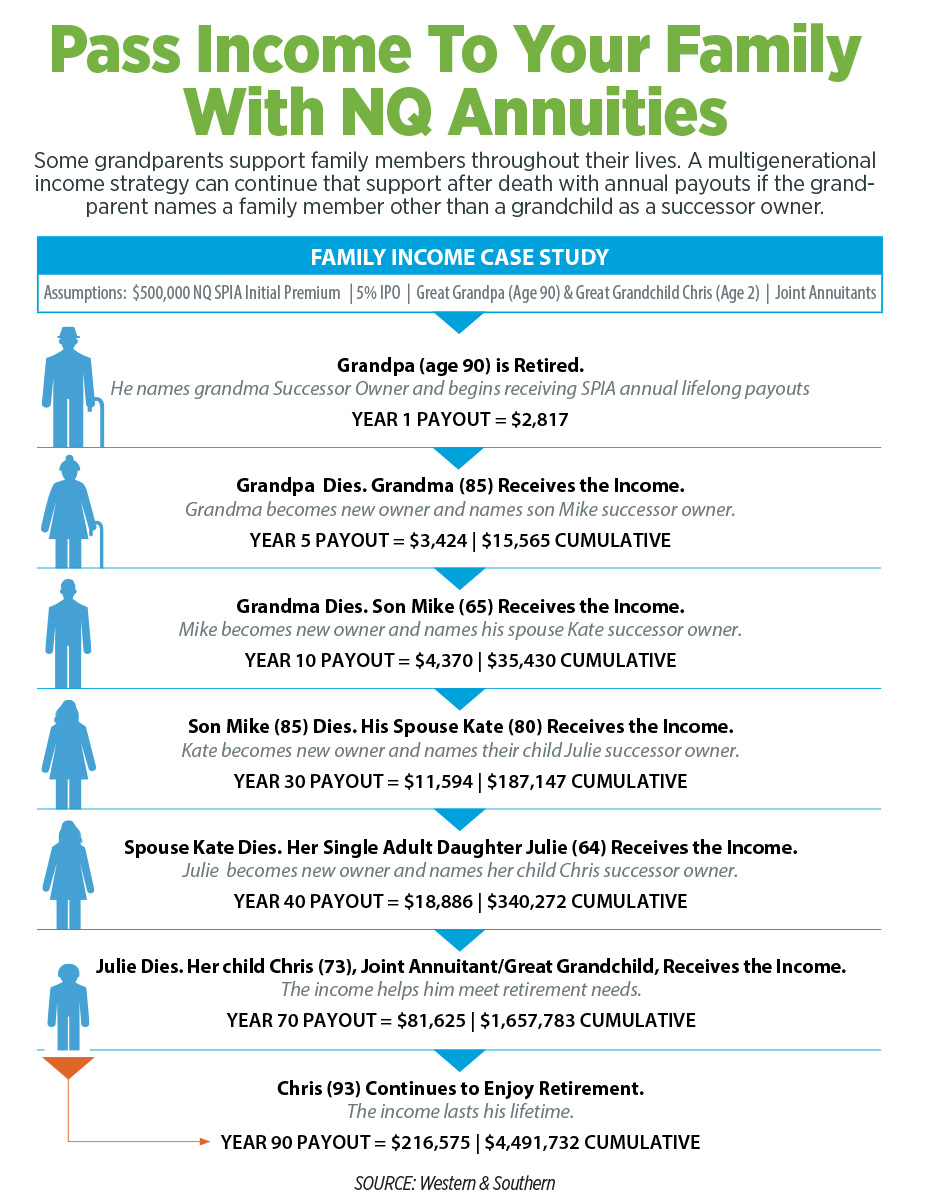

How can an Lifetime Income Annuities help me with estate planning?

Variable annuities: Gives greater capacity for development by investing your cash in investment alternatives you pick and the capability to rebalance your profile based upon your preferences and in a manner that straightens with transforming financial goals. With repaired annuities, the firm invests the funds and supplies a rate of interest to the client.

When a fatality case accompanies an annuity, it is very important to have a called recipient in the agreement. Various choices exist for annuity fatality benefits, depending upon the contract and insurance provider. Choosing a reimbursement or "period certain" option in your annuity supplies a death advantage if you pass away early.

How does an Retirement Annuities help with retirement planning?

Calling a beneficiary various other than the estate can aid this procedure go much more efficiently, and can aid make certain that the profits go to whoever the private desired the cash to go to rather than going with probate. When present, a fatality advantage is immediately included with your agreement.

Table of Contents

Latest Posts

Understanding Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Fixed Index Annuity Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Differe

Understanding Fixed Index Annuity Vs Variable Annuities A Closer Look at Choosing Between Fixed Annuity And Variable Annuity What Is Annuity Fixed Vs Variable? Features of Fixed Indexed Annuity Vs Mar

Understanding Financial Strategies A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Choosing the Right Financi

More

Latest Posts